Insider's Game

Selected writings by David Fiderer

The Panic of 2007 and Blind Faith in Fatally Flawed AAA Ratings

First published in OpEd News on September 20, 2012

Recently, several court cases have examined the rating agencies’ role in setting up the structured investment vehicles (“SIVs”) that collapsed in late 2007. The rating agencies invoked their standard defense, which is that the Panic of 2007 was like a force of nature, a giant tsunami that wiped out all rational expectations of market performance. And consequently no evidence of their culpability may be found.

” As a threshold matter, there can be no serious dispute — despite Plaintiffs astonishing attempt to ignore it — that the global capital markets were gripped by a massive liquidity crisis in the summer of 2007,” claimed the rating agencies’ lawyers. “Plaintiffs [aggrieved investors] must plead facts sufficient, if proved, to exclude the credit crisis as an obvious non-fraud explanation for some discernable portion of their losses.” (Given the evidence presented, it’s hard to overstate the lawyers’ chutzpah in that statement.)

Here the rating agencies are wagging the dog. There was a liquidity crisis. But it was triggered by the fatal flaws in $400 billion worth of SIVs, which were designed and overseen by the rating agencies. Because the totality of collapsing SIVs presented systemic risk, certain bank sponsors, most notably Citibank, were pressured to bail out the SIVs they had arranged. The consequential impact was to reduce bank capital and liquidity and to reduce overall confidence in the system.

SIVs are perhaps the most egregious example of how the rating agencies degraded the term “triple-A” beyond all meaning. The SIV implosion was also a the first act in an 18-month disaster, when investors and banks came to the creeping realization that hundreds of billions of dollars of fatally flawed triple-A bonds were going to get hammered.

An SIV is a bond portfolio financed in the commercial paper market. It makes money from a positive yield curve; short-term paper finances highly-rated long-term bonds.

The SIV business model was predicated on one simple idea: Blind faith in the triple-A ratings. Once that faith was questioned, once investors began to perform some rudimentary due diligence, they discovered why all SIVs were much riskier than all other forms of commercial paper. Beginning in August 2007, the SIVs could neither roll over their commercial paper, nor could they sell off their triple-A and double-A investments.

The rating agencies ascribe this failure to “the market,” in which they played no role. But if you do a deep dive into a lot of these SIVs, you find a series of sham transactions dressed with empty formalities, which belied the obvious bad faith of those who put the deals together.

That’s why a recent unanimous decision, Oddo v. Barclay’s, by New York State’s highest court, the Court of Appeals, was especially disheartening. It seemed as if none of the five justices really understood the business deal; their description of the financial transactions seemed devoid of context, disconnected from the real world. The issue of form versus substance often goes to the heart of the financial crisis.

Time is money, and the reason why people put their blind faith in triple-A ratings was well known. No triple-A-rated bond ever defaulted, ever. Since 1920, before during and after the Great Depression, through wars, recessions and financial scandals, the one constant metric for safety was a triple-A rating.

Of course, there were a relative handful of triple-A companies that deteriorated over the years, were subsequently downgraded, and then defaulted. More than a quarter century after General Motors lost its triple-A rating, it entered bankruptcy. But after the Depression, the journey from triple-A to default was never shorter than four years, at least for Moody’s. Using Moody’s Expected Loss Table [See Appendix E], the expected loss for a triple-A bond over a two-year time span was 0.00001%. Put in dollar terms, the expected loss on a $300 million triple-A bond portfolio was $300.

Which was why SIVs paid close to the risk-free rate. It seemed unthinkable, 28 days after S&P had confirmed the triple-A ratings of two SIVs, Golden Key Ltd. and Mainsail II, that both of those of deals would default. Except that’s exactly what happened. Amazingly enough, the New York Court of Appeals did not find this scenario to be highly suspicious.

It’s the Rollover Risk, Stupid

These two SIVs, and a number of others, were not able to roll over their commercial paper, nor were they able to repay maturing debt by selling off their double-A and triple-A bond investments, which were supposed to be highly marketable. Today, the rating agencies and the SIV sponsors now throw up their hands and say, “Who could have foreseen this meltdown?”

Just about anyone who understands the commercial paper markets. A buyer of commercial expects a clear and cogent answer to a simple and direct question: How can I be sure that I’ll get repaid on time? The answer, except for SIVs, is always the same. In 2007, the same answer applied to Exxon, Lehman Brothers, to AMBAC and to AIG.

Exxon and every other major corporate issuer of commercial paper had a 100% liquidity backup, whereas SIVs did not. If Exxon were faced with bad news, or if the commercial paper market suddenly froze up, it could repay all of its maturing commercial paper, by drawing down on an unused committed bank facility. These bank facilities were set up precisely to deal with that type of market risk, the seemingly remote possibility that the commercial paper market could suddenly become frozen.

Exxon may have been financially stronger than most banks, but in times of market havoc, the banks, not Exxon, had direct access to the discount window of the Fed. That is, during times of market turmoil, a bank that is stretched for cash can always borrow short-term funds from the Federal Reserve, by pledging the notes of its bank loans as collateral.

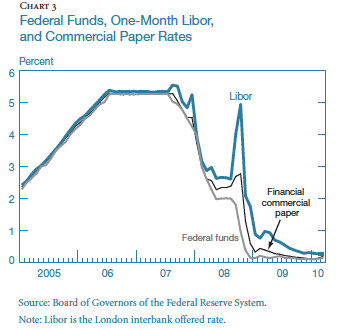

Commercial paper rates were comparable to the fed funds rate because of this indirect access to the Fed’s discount window.

Stronger Than Exxon? Stronger than a Bank?

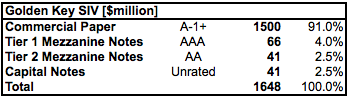

SIVs were part of the shadow banking system–which included Lehman, AMBAC and AIG–because they financed long-term assets with short-term debt, commercial paper that must be continually rolled over. But SIVs were different because they lacked a 100% liquidity backstop; it was more like 8% to 16%. This was why SIV paper was much riskier than all other forms of commercial paper. When Golden Key was launched in 2005, the commercial paper had a 9% liquidity backup provided by pre-funded notes.

The chart above shows how the classes of debt were ranked by seniority, with the most senior debt, the commercial paper, with a short-term rating of A-1+. The next class, which was subordinate to 91% of the total debt, was rated triple-A. By implication, the rating agencies deemed Golden Key’s commercial paper to be much safer than Exxon’s, which is why Golden Key required no more than a 9% liquidity backup. Similarly, Golden Key’s deeply subordinated Tier 1 Mezzanine Notes were deemed by S&P to be as safe as Exxon’s senior unsecured debt. (Moody’s rated Golden Key’s commercial paper but, to its credit, refused to rate the Mezzanine Notes.)

Consider the level of confidence S&P had in the safety of those triple-A notes ranked in the bottom 10% of the capital structure. Only the strongest banks, which all had the implicit support of the Fed, had triple-A ratings assigned to their most senior obligations. (In 2007 these included JPMorgan, Citi and BofA.) By contrast, the bottom 10% of a banks’ capital structure was deemed to be equity, and generally unrated.

Why did Golden Key’s subordinated notes deserve such high credit ratings? Because of the investment portfolio’s grade point average, or in Moody’s nomenclature, a Weighted Average Rating Factor. The SIV was required to maintain a bond portfolio with minimum ratings of triple-A for 30% of the portfolio, and double-A-minus for the remaining 70%.

The rating agencies had extraordinary confidence in an SIV’s ability to withstand a proverbial run on the bank. If a deposit taking institution suffers a run on the bank, it can access the discount window of the fed to maintain sufficient liquidity. If an SIV suffers a run on the bank, i.e. when the CP cannot be rolled over, it should be able to promptly pay off its debt obligations by liquidating its triple-A and double-A bonds at prices close to par.

How could S&P, or anyone, establish such confidence?

Rating Agencies As Bank Regulators

“SIVs were quite frankly banks, just narrowly focused banks,” says Henry Tabe, formerly the SIV guru at Moody’s. The difference was that SIVs were aggressively regulated by the rating agencies. “Unlike banks, structured investment vehicles had restrictions placed on the type of assets they could buy,” Tabe continues. “They had restrictions placed on concentrations of assets; they had restrictions placed on their bankruptcy remote status. So all of these structured finance type features enabled SIVs to be rated triple-A.”

SIVs were not like other rated entities. They were required to demonstrate, each and every business day, that they deserved to retain their triple-A ratings, based on a battery of financial tests. Most of the tests, which were designed and sanctioned by the rating agencies, were calculated daily. And all test results were forwarded to the rating agencies on a weekly basis

So, for instance, Golden Key needed to demonstrate compliance with, among other things, the P-l Capital Test, the Capital Wind Down Test, the CP Coverage Test, the Market Value Coverage Test, the Weighted Average Spread Test, the MCO Limit Tests, the Interest Rate Sensitivity Tests, the Home Equity Loan Interest Rate Sensitivity Test, the Currency Sensitivity Test, the Weighted Average Life Tests, the S&P SIV-Lite Monitor Test and the Mandatory Acceleration Test.

These daily tests were supposed to provide everyone with a high level of assurance that no SIV would ever be compelled to sell any of its bonds at a loss, because they provides early warnings about decreases in the market values.

SIVs are very complicated deals set up to access the commercial paper market. This is why we know that blind faith in triple-A ratings was essential to their marketability.

In the real world, when a manager of a money market fund is asked to evaluate the protections afforded by the Capital Wind Down Test, the CP Coverage Test and the Market Value Coverage Test, he will shut down the conversation right away. Someone who buys commercial paper is looking for a risk-free place to park money for a few days or months. He has neither the time, nor the resources, nor the incentive to devote hours of study to get up to speed about a particular SIV with an ever-changing investment portfolio.

Even if he got to the point when he understood the inner mechanics of an SIV, he would still have a hard time getting comfortable with the idea that the structure was as good as a 100% liquidity backstop. At the end of the day, a manager of a money market fund does not want to hear some long elaborate story about why a particular bond portfolio may be safer than Exxon. It’s just not worth his trouble when he’s getting paid, at best, a few basis points above the fed funds rate.

Plenty of evidence says that SIV investors had no idea what they were buying. SIV paper commanded no pricing premium, recalls Tabe. “Many people within major institutions, some of them sponsors, some of them investors in large volumes of the product, rating agencies, many of them just did not know what SIVs were,” he says, referring to people directly affected by the SIVs’ liquidity crises. “When it was time to take decisive action, [in late summer 2007], the people who could do that just didn’t have the information. People who could do that at all the various institutions were trying to figure out what these vehicles were as they collapsed.”

They were probably trying to recover from the shock of learning that did not have a 100% liquidity backup.

Out of $395 billion worth of SIVs, $25 billion, less than 8%, were called SIV-Lites. Regular SIVs held a mix of different types of bonds–issued by financial institutions and some structured deals–whereas Golden Key, Mainsail and the other SIV-Lites were comprised almost entirely of highly-rated mortgage bonds and CDOs.

Ratings Based On “Market Prices”

According to the rating agencies, each SIV portfolio took a daily measure of the safety of its bonds, based on individual credit ratings and individual “market values.” In a deposition, David Rosa, who rated SIVs for Moody’s in London, explained the rating agency’s thinking. ” Our analysis takes into consideration the market value of the [mortgage] securities and it takes into consideration partly as well the ratings of those securities,” he said. “So to the extent that all this detail is considered by the market to be relevant, that will immediately be reflected in the market value, which we are monitoring.” [Emphasis added.]

Really? This can be accurately measured on a daily basis? Exactly how could that be done? There may be a common belief that most mortgage bonds were actively traded in a secondary market, as if they were equity shares on the New York Stock Exchange. In fact, only a few people, including the rating agencies, had access to information refuting that notion. The “real” trading appears to have been nominal. And opaque over-the-counter markets are subject to zero protections against market manipulation.

The truth was that more than 70% of subprime bonds rated double-A and below were stuffed into CDOs, as the Philadelphia Fed learned years after the crisis. These bonds were never actively traded. In addition, plenty of triple-A and double-A subprime bonds were stuffed into SIVs.

So bonds were bought to be warehoused prior to launch of a newly rated CDO, but secondary cash trades appear to have been nominal. Since the most senior triple-A tranches had average lives below one year, they tended to disappear quickly, which is why Fannie and Freddie bought so many triple-A tranches without increasing their year-end balances. Finally, each securitization tranche is both unique, (about 14 tranches to a single deal), and small, usually well under $100 million.

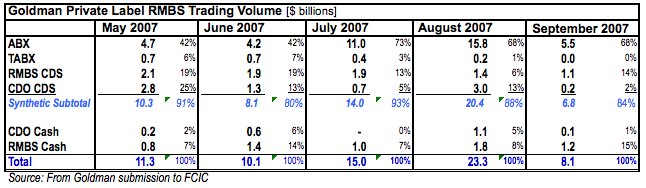

Access to trading numbers is limited, but Goldman’s trading activity, begrudgingly and selectively disclosed to the FCIC, offers some indication of what was going on.

During the months leading up to the panic, about 10% of Goldman’s trading volume was for cash bonds, and only a small fraction of those bonds were rated double-A. For instance, out of 1100 trades executed by Goldman in May 2007, only 8 trades, totaling $90 million, were for cash bonds rated double-A.

How can anyone expect to do an accurate daily mark-to-market valuation of highly complex bonds that are not actively traded?

We find the answer in the deal’s definition of “Market Value”; which provides for Option A, then Option B, then Option C:

“Market Value” meant, on any business day, for each and every investment:

(A) The higher of two bona fide bids from two internationally recognized dealers; however,

(B) If two such bids could not be obtained, then the price quoted by an independent pricing service; however,

(C) If the SIV managers cannot in good faith determine the market value via A and B above, then the value shall be determined by the SIV managers according to their reasonable business judgment. [See page 317 of pdf]

So, in plain English, a fallback method for ascertaining “market values,” was what the SIV managers’ reasonable business judgment, which is a meaningless reality test. They could come up with whatever values they wanted because, according to the New York Court of Appeals, they had no duty to protect investors. And the rating agencies had no obligation to set up a structure that was more reliable than garbage in, garbage out.

It wasn’t just Option C that was bogus; it was Options A and B as well.

But if an SIV asked a dealer, every single business day, for quotes on 100 different structured bonds, he would know that the SIV was not serious about selling. And his indicative quotes, which were not firm offers, were not exactly serious either. If an SIV got updated quotes from dealers on a daily basis, it’s highly likely that those quotes were no more than an empty formality used to validate the SIV compliance tests.

It’s also important to remember that the banks, which acted as dealers and market makers for mortgage bonds, were also selling off newly minted CDOs. So long as these banks were able to sell CDOs, they had an incentive to prop up the “market prices” of mortgage bonds held by CDOs. So long as subprime bonds had “market prices” that were close to par, prospective buyers of CDOs might be lulled into a false belief about the level of safety of those deals. But after the rating agencies began to downgrade subprime bonds in July 2007, these bankers recognized that the music had stopped. They could no longer repackage dodgy bonds into newly minted CDOs, so they had less of an incentive to “make markets” for subprime bonds.

By August 2007, Wall Street banks knew that further downgrades of subprime bonds, including those rated double-A, were certain to occur, based on default of foreclosure levels on 2005 and 2006-vintage deals. So all bets were off.

The SIV structure was supposed to address a question: In a worst-case scenario, what kind of price drop would you see in a particular type of bond? This presented a problem for the rating agencies, since they had no history or had accumulated no data on the prices of mortgage bonds in the secondary market.

So the rating agencies just kind of made up some assumptions. And from those assumptions, they could figure out what kind of discount, or haircut to assume in case mortgage bonds needed to be sold in a distressed market.

“Making It All Up: Methodology for Structured Investment Vehicles (“SIVs’)”

William Harrington, a former senior vice president in the structured finance group at Moody’s, noticed the problem back in 2005, and described it in his devastating takedown offered to the S.E.C. [1] In one section, “Making It All Up: Methodology for Structured Investment Vehicles (“SIVs’),” he recalled a computer lab training session attended by himself and some colleagues 2005, when where they were introduced to a Moody’s model for estimating the haircuts on bond prices sold under an SIV liquidation scenario. ” The training session left the contributor confused,” wrote Harrington, who referred to himself as the contributor. So far as he could tell, the methodology simply didn’t add up. So Harrington asked a colleague if he had missed something. “The colleague replied that nothing about SIVs added up. In rating SIVs, analysts ran the SIV tool and presented the output to Henry Tabe, their manager. Mr. Tabe then disregarded the output and made up haircuts that were palatable to SIV issuers [i.e. the Wall Street banks].” At that point, Harrington decided that he wanted nothing more to do with SIVs.

Little did Harrington know that two years later, SIVs would make history, as the first ever triple-A-rated bonds to default. They were a trickle before the flood.

__________

[1] Harrington’s 2011 submission was in response to the S.E.C.’s solicitation of comments on proposed regulations for the rating agencies.