Insider's Game

Selected writings by David Fiderer

Why No Other Republican Would Sign On to Peter Wallison’s FCIC “Report”

First published in OpEdNews on January 27, 2011

| (Scoop Alert: The following was first published on the same day that the final Report by the Financial Crisis Inquiry Commission, with all dissenting opinions, was first published. It later became apparent that Wallison’s claim–that the FCIC ignored Ed Pinto’s research, was a flat out lie.)

It’s obvious why other Republicans on the FCIC were unwilling to attach their names to Peter Wallison’s magnum opus. They don’t want to set themselves up for ridicule. It’s one thing to be an apologist for the Wall Street and its abuses. It’s quite another to promote an alternate reality. Wallison’s “report” is essentially a rehash of articles and op-ed pieces put out by the American Enterprise Institute over the past two years. He draws conclusions from “data” that almost nobody else considers valid.

It’s all there in the first paragraph of his summary, and in his chart below:

Although there were many contributing factors, the housing bubble of 1997-2007 would not have reached its dizzying heights or lasted as long, nor would the financial crisis of 2008 have ensued, but for the role played by the housing policies of the United States government over the course of two administrations.

As a result of these policies, by the middle of 2007, there were approximately 27 million subprime and Alt-A mortgages in the U.S. financial system–half of all mortgages outstanding–with an aggregate value of over $4.5 trillion.4 These were unprecedented numbers, far higher than at any time in the past, and the losses associated with the delinquency and default of these mortgages fully account for the weakness and disruption of the financial system that has become known as the financial crisis.

Defining “Subprime” and “Alt-A” The AEI Way

Almost nobody else uses Wallison’s unique definitions for “subprime” and “Alt-A,” not the GAO, not the St. Louis Fed, not the Dallas Fed, not the Federal Housing Finance Association, not the Mortgage Bankers Association, not the New York Fed, not Moody’s, not Lender Processing Services, not Inside Mortgage Finance, not CoreLogic, not the rest of the FCIC. That’s why nobody else calculates the number of nonprime mortgages to be anything close to 27 million.

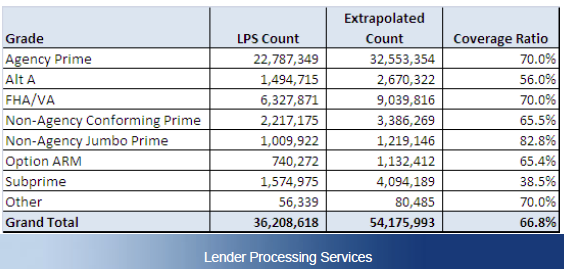

For almost everyone else, “subprime” or “Alt-A” are categories that, when taken together, represent a small percentage of the U.S. total. For instance, LPS, using own definitions, calculates that 4.1 million subprime loans, combined with 2.7 million Alt-A loans, represented about 13% of the U.S. total as of June 2010. Edward Pinto, who devised the AEI definitions and calculated Wallison’s numbers, is clear about what he did. He began with his estimates of “self denominated” subprime (7.7 million) and Alt-A loans (1.1 million), which he claimed to have totaled 8.8 million, and then, by using his expansive definitions, tripled that number, to 26.7 million.

How The GSEs Compare To Everyone Else

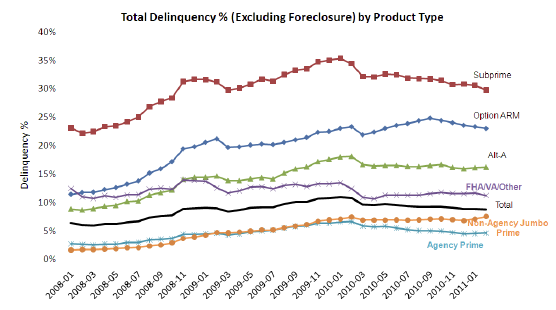

LPS calculates that the performance of Agency Prime loans perform exponentially better than all other categories of mortgage loans, and FHA loans perform a lot better than either Alt-A of subprime loans (as defined by LPS).

This is where the Pinto/Wallison thesis falls apart. At the end of the day, it doesn’t matter whether you use Pinto’s definitions or someone else’s definitions. What matters is performance, not labels. In the non-Pinto world, the most commonly used benchmark for measuring loan performance is the rate of “serious delinquencies” as defined by the Mortgage Bankers Association, that is, the percentage or number of loans that are 90 days delinquent or in the process of foreclosure. And it’s important to consider the progression of those numbers over time.

We can track GSE loan performance each month, using reports published by the FHFA. (More specifically, these loans were directly purchased or guaranteed by Fannie and Freddie; they are not pieces of loans embedded in private label securitizations.) We can also track nationwide mortgage loan performance each month using made available to the public by LPS. So we can compare GSE performance with the rest of the mortgage market. It’s not even close.

The rate of serious delinquencies among non-GSE loans is about three times higher than it is among GSE loans. As of October 2010, per LPS, there were about 53.3 million mortgage loans, of which about 4.3 million were seriously delinquent. The GSEs had about 29.9 million loans, of which about 1.3 million were seriously delinquent. So, using simple arithmetic, the non-GSE market had about 23.4 million loans, with about 3 million serious delinquencies. There are more than twice as many seriously delinquent loans in the non-GSE market. This relationship has held steady for close to two years.

The FHFA echos those findings every quarter, when it compares the GSEs’ serious delinquency rate, and the FHA’s serious delinquency rate, with that of the total market, as measured by the Mortgage Bankers Association. The FHFA, in its chart below, references the performance of subprime loans as defined by the MBA, which found that the subprime category represented about 11% of the U.S. total. (The MBA does not track Alt-A, some of which may be categorized as prime, some as subprime.)

A recent FHFA study found that private label deals performed four times worse than those originated for the GSEs. And when compared on an apples-to-apples basis, (over 1,800 comparisons adjusted for FICO score, year or origination, LTV and fixed versus ARMs) the GSE loans in virtually every case performed substantially better. That’s why nobody but Wallison would dare to insinuate that most of the toxic loans in the marketplace were originated by Fannie or Freddie. The data shows nothing to absolve the GSEs or their management of anything, but it does indict those responsible for putting out private label securitizations, for which the spectacularly bad performance is of an entirely different magnitude.

And that’s why it’s dishonest for Wallison to dismiss, as he has done repeatedly over the past two years, the impact of Wall Street’s originate-to-distribute model, in which none of the gatekeepers in the distribution chain–the mortgage brokers, the nonbank lenders, the rating agencies, the Wall Street banks–ever intended to retain the credit risk, or took any reasonable steps to limit fraud.

Only a hack could claim that the loan portfolios of Fannie and Freddie performed as poorly as the rest of the U.S. mortgage market. But what would expect from someone who proudly attached his name to the following:

[T]here is no evidence that the “interconnections” among financial institutions alleged to have caused the crisis were significantly enhanced by CDS or derivatives generally...

[N]o significant deregulation of financial institutions occurred in the last 30 years…

[V]irtually all participants in the financial system failed to foresee this crisis…

The Commission’s report also blames predatory lending for the large build-up of subprime and other high risk mortgages in the financial system. This might be a plausible explanation if there were evidence that predatory lending was so widespread as to have produced the volume of high risk loans that were actually originated.

|