Insider's Game

Selected writings by David Fiderer

Alan Greenspan’s Financial History for Lobotomy Victims

First published in The Huffington Post on May 25, 2010

Atlas shrugged all right. Ayn Rand’s famous disciple whitewashes his past with the foggy rhetoric of collectivism. The meltdown was caused by, “the powerful economic forces that emerged in the aftermath of the Cold War,” argues the former Fed Chairman. Rejecting the capitalist values of choice and personal accountability, he filters history through an intellectual construct where no one — most notably Alan Greenspan — ever takes the blame.

Before getting bogged down in Greenspan’s blather and dissembling, here’s an executive summary for those who remember what happened:

Before and After the Bush Years: The Numbers From a Capitalist Perspective

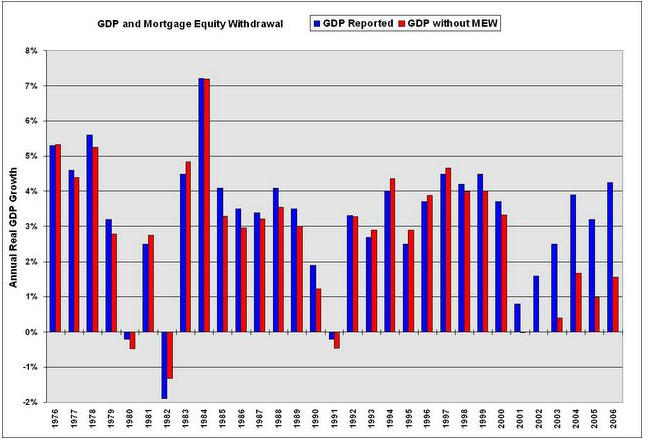

At the beginning of 2001, U.S. home mortgage debt was $5 trillion. At the end of 2006, it was $10 trillion. During those same six years, Americans withdrew $3.8 trillion in mortgage equity, twice the amount withdrawn throughout the entire 1990s. As Calculated Risk pointed out, the vast majority of GDP growth during those six years was traceable to that mortgage equity withdrawal.

This upward leveraging represented a sharp break from the past. From 1990 through 2000, home mortgage debt was about 50% of U.S. GDP. By the end of 2006, it was 73% of GDP, and two times the amount of Federal debt owed to the public. Throughout the 1980s and 1990s home mortgage debt was approximately equal to the size of Federal debt owed to the public.

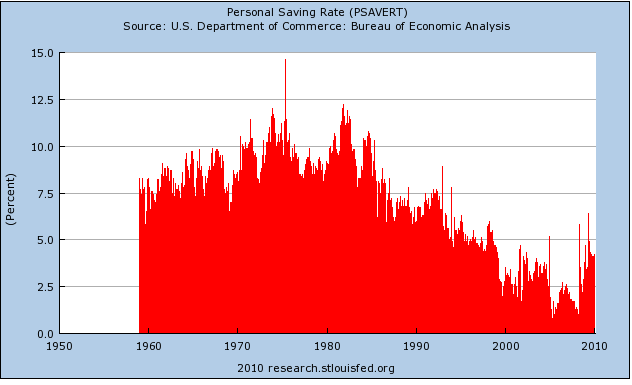

The recklessness of this mortgage equity withdrawal was obvious, given the country’s steadily declining personal savings rate.

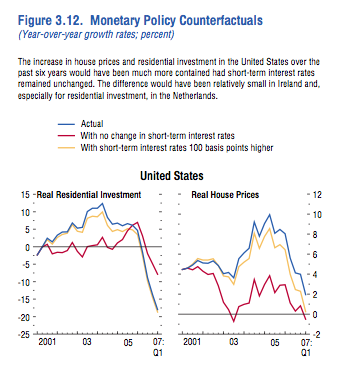

Why did mortgage debt double in six years? Because the rise in home values was driven by low interest rates, as demonstrated by the IMF study cited by Greenspan in his paper.

Greenspan began slashing interest rates as soon as George W. Bush secured the Presidency in 2000. On December 31, 2000, the Fed Funds rate was 6-1/2%; by May 15, 2001 it was 4%; by November 2 it was 2%. Greenspan kept lowering rates, which he kept below 2% for three three years subsequent to the mild recession that ended in November 2001. Only after Bush secured his reelection in November 2004 did Greenspan raise the Fed funds rate back to 2%. The Fed Funds rate was restored to 4-1/2% when Greenspan left office at the end of January 2006, a few months before the real estate bubble began to collapse.

That $5 trillion incremental increase in home mortgage debt, much of which cannot be repaid, has permanently damaged our country’s financial standing. One out of four homeowners with a mortgage has negative equity. The majority of under water mortgages are concentrated in four states: California, Florida, Arizona and Nevada.

When The Government Stopped Policing Fraud

That $5 trillion incremental increase is also traceable to a major policy shift from Clinton Administration policies to root out and prevent mortgage fraud. In 2000, fraud within the subprime mortgage sector was a huge story, covered by The New York Times, The Washington Post and ABC. Major subprime lenders such as The Money Store, First Alliance and ContiMortgage all shut down. After assessing the cumulative data from regulators and academic studies, HUD Secretary Andrew Cuomo declared, “Evidence indicates that the vast majority of mortgage fraud and predatory lending activities…occurs in the conventional subprime lending market.” In June 2000, a joint HUD/Treasury Task Force recommended, among other things:

1. Laws to limit fraud by mortgage brokers,

2. Laws against negative amortization mortgages, and

3. Laws to prohibit Fannie and Freddie from making secondary purchases of loans secured without the due diligence necessary to confirm that the borrower could repay his obligation, i.e. a prohibition against no doc or “liar loans” and a prohibition against loans that were clearly beyond the means of the borrower.

In March 2000, Rep. Jan Schakowsky introduced legislation designed to prevent undue pressure on appraisers to inflate home valuations. In August 2001, 6000 appraisers signed a petition seeking government protections.

But by then it was too late. Phil Gramm had declared that no legislation against fraud was necessary because the data was anecdotal and the definition of predatory lending was unclear. He prevented any legislation from moving forward. In a 2001 prequel to the rants popularized Rick Santelli and Larry Kudlow, Gramm said the problem was the “predatory borrowers.”

During the 2001 – 2006 real estate bubble, efforts to police mortgage fraud were consistently thwarted by the Bush Administration and Alan Greenspan. As Eliot Spitzer explained earlier, the Bush Administration, “embarked on an aggressive and unprecedented campaign to prevent states from protecting their residents from the very problems to which the federal government was turning a blind eye…[through] the Office of the Comptroller of the Currency (OCC).”

In 1994 Congress had passed Home Ownership and Equity Protection Act (HOEPA), which states: “The [Federal Reserve] Board, by regulation or order, shall prohibit acts or practices in connection with mortgage loans that the Board finds to be unfair, deceptive or designed to evade the provisions of this [legislation].” Despite a mountain of evidence of mortgage abuses, and a specific request by Board Governor Edward Gramlich to address the problem, Greenspan consistently refused to do anything.

Three prequels to the meltdown:In spite of three massive regulatory failures under his watch – the S&L Crisis, Long Term Capital Management, and Enron – Greenspan ignored the systemic dangers of mortgage fraud going viral, and the blind spots in financial markets dominated by hedge funds and credit derivatives, which grew exponentially after Phil Gramm’s Enron Loophole was enacted in December 2000. When called to testify before Congress in October 2008, Greenspan acted like an amnesia victim, claiming: “I was shocked because I’d been going for 40 years or more with very considerable evidence that it was working exceptionally well.”

Greenspan stepped up his campaign to obliterate history with his so-called “mea culpa” presented last Friday before the Brookings Institution. But his tepid “mistakes-were-made” concession gets lost amid 40 pages of half-truths and distortions. Here are some red herrings with a particularly acrid stench:

“The Global Savings Glut:” Like the juvenile delinquent who blames society for his crimes, Greenspan ascribes his low-interest rate policies to “global savings intentions [which] of necessity had chronically exceeded global intentions to invest.” Except there were no excess savings within the United States. Tax cuts had caused an unprecedented decline Federal Revenues, while the country geared up from a new war and became ever more indebted to China. Yet Greenspan saw no reason to curb Americans’ appetite for borowing. About 80% of subprime mortgages were based on short-term rates kept artificially low by Greenspan.

Affordable Housing Policy: Greenspan also invokes right-wing mythology, which blames the mortgage crisis on Fannie Mae and Freddie Mac. “Pressed by the Department of Housing and Urban Development and Congress to expand ‘affordable housing commitments,’ they chose to meet them by investing in subprime securities,” he writes. He excludes critical facts to twist things around. The Washington Post revealed that HUD, under the Bush Administration, “neglected to examine whether borrowers could make the payments on the loans that Freddie and Fannie classified as affordable.” This was a clear reversal of Clinton Adminsitration policy. So in 2004, when HUD revised its goals and started ignoring the predatory nature of the loans, Fannie and Freddie’s subprime purchases of skyrocketed. These loans promoted the opposite affordable housing. But they did promote the business of the nation’s biggest subprime lender, and Bush’s largest donor, Roland Arnall’s Ameriquest. Also, less than 10% of subprime loans were extended to first-time homebuyers.

The Black Swan/Irrational Exuberance Excuse: Here Greenspan ventures into complete fantasy:

The current crisis has demonstrated that neither bank regulators, nor anyone else, can consistently and accurately forecast whether, for example, subprime mortgages will turn toxic, or to what degree, or whether a particular tranche of a collateralized debt obligation will default, or even if the financial system as a whole will seize up.

The job of a regulator is not to “consistently and accurately forecast” anything. It’s to assess whether the risks being taken are reckless, and whether the prevalence of reckless activity threatens the system. It’s a job that Greenspan refused to perform, despite the signals from the S&L crisis, LTCM and Enron. But as it happens, any novice could figure out that the subrpime bonds were destined to fail. In MASTR Asset Backed Securities Trust 2005-NC2, which was very typical, 100% of the loans were interest-only, 60% of the loans closed with second liens (leaving the homeowners with zero equity), 58% relied on “stated documentation,” and 55% of which were in California. Common sense tells you that the prevalence of liar loans and zero-equity homeowners in an overheated market will lead to big trouble.

The Phony Disconnect Between Mortgages and Short-Term Rates: Greenspan also resuscitates that old canard, that housing prices, and the bubble, were tied to long-term rates, not to the short-term rates that he slashed. Go here for a recounting on how he promoted adjustable rate mortgages to consumers who should have avoided them.

Of course the real estate bubble did eventually pop, following a typical monetary time lag of six to twelve months, after Greenspan restored the Fed funds rate above 4%.