Insider's Game

Selected writings by David Fiderer

Is Fannie Mae Seriously Over-Provisioned?

First published in on November 18, 2014

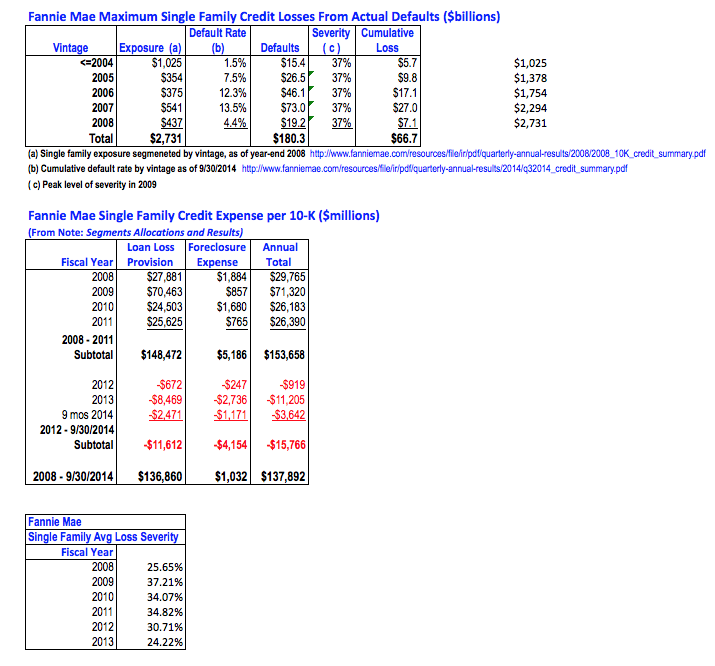

It’s hard to write about finance with flair and specificity, especially without a bunch of charts and financial schedules to illustrate the point. In a piece published by National Mortgage News yesterday, one of several points I wanted to make was that Fannie Mae recognized huge non-cash accounting losses during 2008 – 2011. And when the housing market turned the corner in 2012, those non-cash losses reversed themselves.

Also, some of the cash draws made no sense. If you are well versed in accounting, then you would know that drawing down cash to “bail out” the loss of deferred tax assets is pure idiocy.

Fannie Mae, which discloses cumulative default rates by vintage, enables one to try and reconcile actual cash losses, from loan liquidations, and earlier loan loss provisions. No doubt about it, more losses on the pre-2009 mortgages will arrive in the future. Nonetheless, it sure looks like Fannie Mae is long overdue for reversing more of those 2008 – 2011 provisions.

Oh, and by the way, you’ll see I made a mistake in National Mortgage News. Total estimated credit losses are below $67 billion, not $74 billion as I wrote in the piece.