Insider's Game

Selected writings by David Fiderer

Debunking the Bogus Story About Tim Geithner and the AIG “Coverup”

First published in The Huffington Post on January 10, 2010

[Updated on 1/11/10 12:30 pm to include an explainer of how the payouts worked.]

Let’s start with the most obvious problem concerning the story, first reported by Bloomberg, “Geithner’s Fed Told AIG to Limit Swaps Disclosure.”

It’s not true. Doesn’t anybody fact check any more?

Bloomberg writes:

The Federal Reserve Bank of New York, then led by Timothy Geithner, told American International Group Inc. to withhold details from the public about the bailed-out insurer’s payments to banks during the depths of the financial crisis, e-mails between the company and its regulator show.

AIG said in a draft of a regulatory filing that the insurer paid banks, which included Goldman Sachs Group Inc. and Societe Generale SA, 100 cents on the dollar for credit-default swaps they bought from the firm. The New York Fed crossed out the reference, according to the e-mails, and AIG excluded the language when the filing was made public on Dec. 24, 2008. The e-mails were obtained by Representative Darrell Issa, ranking member of the House Oversight and Government Reform Committee.

The details were never withheld from the public. Specifically, AIG made full disclosure that it paid out banks 100 cents on the dollar in SEC filings dated December 2, 2008, after $46.1 billion worth of CDOs had been acquired, and on December 24, 2008, after an additional $16 billion had been acquired.

Most commentators describe the AIG bailout like blind men describing an elephant. Here’s what actually happened:

2005 – 2007: AIG extended credit default swap protection to a group of banks that held $61.1 billion of collateralized debt obligations (“CDOs”).

Prior to July 31. 2008: AIG paid out $16.8 billion in cash collateral based on the reduced value of those CDOs.

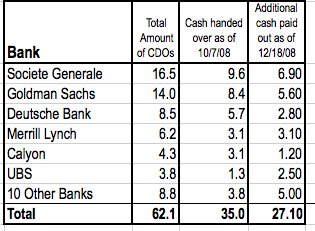

October 7, 2008: AIG paid out an additional $18.1 billion in cash collateral based on a further reduction in the value of those CDOs. At this point, $35 billion ($0.1 rounding error), or 56% of the total $62 billion value, has been paid out on those CDOs; this leaves $27.1 billion unfunded.

November 8, 2008: The New York Fed agrees to fund $27.1 billion, on top of the cash collateral previously paid out, in exchange for termination of the credit default swaps and acquisition of the entire $62.1 billion CDO portfolio. In other words, the net benefit to the banks is $27.1 billion, and the net value obtained in exchange is whatever cash flows those CDOs would eventually recover. The deals closed over the subsequent six weeks.

December 2, 2008: AIG’s SEC filing says that it has acquired the first $46.1 billion of the CDOs, for $20.1 billion in cash and for the release of $26.1 billion in cash collateral. People who understand CDOs and AIG can also do simple arithmetic, so than see that the banks were paid $46.1 billion for $46.1 billion in CDOs, or 100 cents on the dollar.

December 24, 2008: AIG’s SEC filing says that it has acquired the final $16 billion of the CDOs, for $6.2 billion in cash and for the release of $8.7 billion in cash collateral (plus a $0.1 billion rounding error). People who understand CDOs and AIG can also do simple arithmetic, so they see that the banks were paid $16 billion for $16 billion in CDOs, or 100 cents on the dollar. This SEC filing includes an amendment to a previously disclosed agreement which makes clear that $62.1 billion in CDOs has been acquired. At this point, the $62.1 cash payment for CDOs with a face amount of $62.1 billion has been fully disclosed.

Again, the people who follow financial institutions like AIG read this stuff very carefully, and they can do simple arithmetic. You might argue that that AIG’s disclosure the 100-cents-on-the-dollar payout was not so obvious to the man on the street. But a claim that the New York Fed directed AIG to conceal the information is as false as saying 2 + 2 = 5.

Geither’s name shows up nowhere on the notorious e-mail correspondence. If anyone were interested in understanding the full story of the e-mails, he would first ask questions of the people who wrote the e-mails. But people like Darrell Issa are not interested in getting at the truth, only in shaping the media narrative.

Here was the payout to the banks:

The language in the SEC filings is set forth below:

On November 25, 2008, ML III bought approximately $46.1 billion in par amount of Multi-Sector CDOs through a net payment to CDS counterparties of approximately $20.1 billion, and AIGFP terminated the related CDS with the same notional amount. The aggregate cost of the purchases and terminations was funded through approximately $15.1 billion of borrowings under the Senior Loan, the surrender by AIGFP of approximately $25.9 billion of collateral previously posted by AIGFP to CDS counterparties in respect of the terminated CDS and AIG’s equity investment in ML III of $5.0 billion.

AIG Financial Products Corp. (“AIGFP”), the Federal Reserve Bank of New York (“NY Fed”) and Maiden Lane III LLC (“ML III”) have previously entered into agreements with AIGFP counterparties to terminate credit default swaps and other similar instruments (“CDS”) written by AIGFP and to have ML III acquire the related multi-sector collateralized debt obligations (“Multi-Sector CDOs”). On December 18, 2008 and December 22, 2008, ML III purchased $16 billion in par amount of additional Multi-Sector CDOs, including approximately $8.5 billion of Multi-Sector CDOs underlying 2a-7 Puts written by AIGFP.

The purchase of these Multi-Sector CDOs was funded with a net payment to counterparties of approximately $6.7 billion and the surrender by AIGFP of approximately $9.2 billion in collateral previously posted by AIGFP to CDS counterparties in respect of the terminated CDS.

And anyone who read the emails, and understood the nature of the correspondence, could tell you the President of the New York Fed had far more important things to worry about than those drafting decisions. As for the email correspondence in March 2009, Geithner was no longer at the New York Fed at the time.