Insider's Game

Selected writings by David Fiderer

The Fannie Mae Accounting Scam Promoted by the Chairman of the S.E.C.

First published in The Huffington Post on November 22, 2010

There are myriad accounting tricks to deceive the public, but Christopher Cox chose one of the simplest. The Chairman of the S.E.C. moved billions of dollars from one side of the ledger to the other side, but didn’t mention how he had shifted the numbers. He then filed a lawsuit charging Fannie Mae with concealing $11 billion in losses, despite the fact that those losses had actually been disclosed in Fannie’s public financial statements, in a category called “Accumulated Other Comprehensive Income (Loss).” He bamboozled Congress, the press, the public and the U.S. District Court into thinking that Fannie was not transparent about what it was doing. Nothing better exemplifies the extent to which he politicized the regulatory function of his agency.

Cox didn’t act alone. The S.E.C. collaborated with Office of Federal Housing Enterprise Oversight on a two-year investigation into Fannie Mae’s books. Disregard for Generally Accepted Accounting Principles “resulted in Fannie Mae overstating reported income and capital by a currently estimated $10.6 billion,” said the OFHEO. The 340-page OFHEO report and the 23-page S.E.C. complaint allege all sorts of accounting infractions, but neither specified where the multibillion-dollar losses actually came from. This was back in the halcyon days of May 2006, when Fannie’s regulators insisted that it was excessively conservative in its lending policies.

The S.E.C. complaint alleges a panoply of accounting violations, but almost all of them are rounding errors, nickel and dime stuff in the context of a trillion dollar balance sheet and billions of dollars in reported earnings. For instance, the S.E.C. said Fannie misrepresented its financial position because it accrued 30.4 days of interest each month, instead of using the actual number of days. It also said Fannie had defrauded investors by making $100 million in excessive provisions for loan losses. Virtually all of the $11 billion shortfall was attributed to improper designation of financial hedges. Here’s the critical paragraph in the S.E.C. complaint:

The Company disregarded the requirements of [Financial Accounting Standard] 133 and qualified transactions for the “short-cut” method based on erroneous interpretations and an unjustified reliance on materiality. By failing to comply with the requirements of SFAS 133, the Company failed to qualify for hedge accounting. This failure led to the Company publicly issuing materially false and misleading financial statements for the periods covering the first quarter 2001 to the second quarter 2004. The vast majority of the anticipated restatement of at least an $11 billion reduction of previously reported net income is a result of Fannie Mae’s improper hedge accounting.

The S.E.C. makes two critical points: 1. Fannie improperly failed to mark-to-market certain financial positions, and 2. The S.E.C. reviewed those financial positions and found that the net positions created billions of dollars in losses. Testifying before Congress, Cox characterized the $11 billion number as, “the lower bound of the estimate.” The whole case revolves around the application of FAS 133.

When it was first implemented, FAS 133 gave companies a lot of latitude as to how they could recognize noncash mark-to-market gains or losses. One company might choose to recognize the change in value on its income statement. Another company might characterize the same item as an adjustment to shareholders equity, rather than on the income statement. The adjustment would be disclosed as, “Accumulated Other Comprehensive Income (Loss).” Either way could be acceptable under FAS 133 — it is literally six of one, half dozen of another — and any junior analyst would adjust for those differences when evaluating financial performance.

The essence of the S.E.C.’s case is its contention that Fannie committed fraud by recognizing the gains and losses as direct adjustments to equity instead of putting them on the income statement. That’s a common form of window dressing, but the only people who would be misled would be those who don’t know how to read financial statements. And even if you think the distinction is valid, it was dishonest of the S.E.C. and the OFHEO to withhold the fact that the changes in net income were derived by reversing out items elsewhere in the financial statements, and the fact that Fannie had publicly disclosed its FAS 133 losses.

For 2001 and 2002, Fannie recognized $11.8 billion in losses in the category of Accumulated Other Comprehensive Income (Loss). They included, for 2001, a $4 billion loss for “Transition adjustment from the adoption of FAS 133,” plus another $3.4 billion loss for “Net cash flow hedging losses on derivatives hedging debt.” In 2002, Fannie recognized another $8.9 billion loss in “Net cash flow hedging losses on derivatives hedging debt.” All of this is set forth, clear as day, on page 124 of its 2003 10-K. Nobody, or at least nobody who is minimally competent, could miss it.

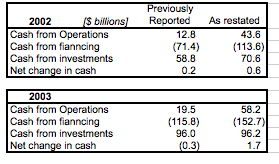

Also, when Fannie was forced to unravel all the financial positions it had deemed as hedges, the net result showed billions in dollars of gains, not losses. By reversing the previously recognized AOCI losses, plus by recognizing the market-to-market gains in AOCI, shareholder equity for year-end 2002 had almost doubled, from $16.3 billion to $31.9 billion.

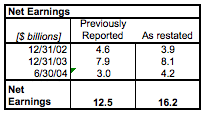

When Fannie Mae released its restated financials in December 2006, six months after the overblown media narrative about Fannie Mae’s accounting problems had calcified into the zeitgeist, almost no one looked at the numbers and asked where they came from. By every standard metric — cumulative net income, shareholder equity, corporate cash flows — Fannie’s financial position turned out to be far stronger than originally reported.

But that’s not how the media perceived it. The company, which already settled with the S.E.C., was loathe to challenge or embarrass its regulators and gave only selective data in its press release: “The cumulative impact of the restatement was a total reduction in retained earnings of $6.3 billion.” The dominant narrative, that Fannie was a corrupt, out-of-control enterprise, seemed to be set in stone.

When Cox and Lockart announced their phantom $11 billion losses, politicians were quick to make comparisons to Enron and Worldcom. “It’s fair to argue that this is perhaps more significant or more grave than Enron,” said Senator Richard Shelby. “Though, perhaps the biggest difference at the moment is that the guys at Enron have been convicted.” As it turns out, no one misrepresented Fannie’s financial position more egregiously than Cox and Lockhart.

None of the foregoing suggests that Fannie is anything but a financial basket case today. But its losses are not from trading, but from credit losses on bad loans. Why is any of this important today? Because pundits and politicians like to conflate issues. When the OFHEO first argued that timing differences feeamortization represented “systemic risk” in October 2004, Barney Frank and other Democrats argued several things: That any earnings manipulation should be punished, that the OFHEO had not quantified any FAS 133 gains or losses, and that the shifting of income from one period to the next is not the same thing as a direct threat to safety and soundness.

Bush administration regulators pushed Fannie and Freddie into high-risk loans, which is why Republicans are eager to claim that Fannie’s chief enabler was a congressman in the minority party helped draft GOP-sponsored legislation for increased government oversight.

Also, Lockhart’s deputy, a holdover from the Bush administration, is Fannie’s chief regulator and has an incentive to sanitize his predecessor’s feeble record.