Insider's Game

Selected writings by David Fiderer

How Fraudster Economists Assert That “Higher Taxes Won’t Reduce the Deficit”

First published in OpEdNews on December 8, 2010

Rather than confront the evidence of their own failures, fraudster economists, like Stephen Moore at Free Enterprise Fund and Richard Vedder at the American Enterprise Institute, double down on their lies. They manufacture phony evidence to establish that “Higher Taxes Won’t Reduce the Deficit,” and get their scam promoted on the editorial page of The Wall Street Journal.

Here’s how they do it:

In the late 1980s, one of us, Richard Vedder, and Lowell Gallaway of Ohio University co-authored a often-cited research paper for the congressional Joint Economic Committee (known as the $1.58 study) [actually, it was the $1.59 study] that found that every new dollar of new taxes led to more than one dollar of new spending by Congress. Subsequent revisions of the study over the next decade found similar results.

We’ve updated the research. Using standard statistical analyses that introduce variables to control for business-cycle fluctuations, wars and inflation, we found that over the entire post World War II era through 2009 each dollar of new tax revenue was associated with $1.17 of new spending. Politicians spend the money as fast as it comes in–and a little bit more.

Translation: After Clinton raised taxes, deficits shrank but did not go away until 1999. Ergo, “Subsequent revisions of the study over the next decade found similar results.” Ergo, raising taxes does not reduce the deficit. And when you consider the entire post-war period, taxes rarely exceeded expenditures. So raising taxes will not reduce the deficit. And let’s ignore how tax cuts caused deficits to explode.

It’s all designed to preempt any kind of honest debate. “The grand bargain so many in Washington yearn for–tax increases coupled with spending cuts–is a fool’s errand,” they write. “Our research confirms what the late economist Milton Friedman said of Congress many years ago: ‘Politicians will always spend every penny of tax raised and whatever else they can get away with.'”

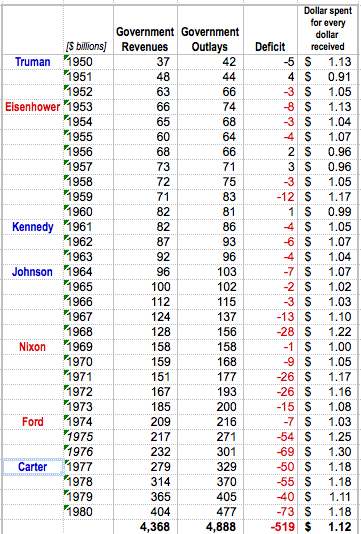

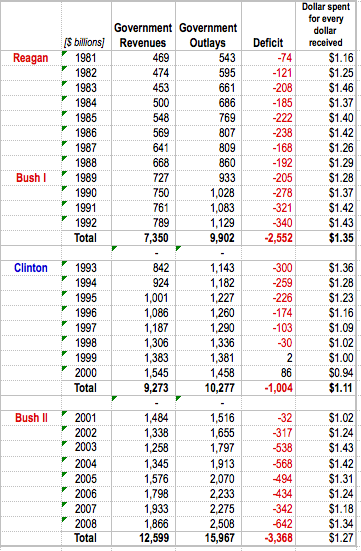

Here’s the truth: Between 1950 and 1980, the U.S. government spent $1.12 for every dollar of revenue. During the Reagan/Bush years of 1981 through 1992, the government spent $1.35 for every dollar of revenue. During the Clinton years, the government spent $1.11 for every dollar of revenue. But that average obscures the progress made toward deficit reduction during that period. Here are the real numbers that refute these dissembling crackpots:

Source: OMB On Budget Revenues and Outlays See 1950-1980 data below.

The biggest driver in deficit reduction is economic growth. When the GDP rises, and more people have jobs, more tax revenues come in. The evidence on tax cuts is overwhelming. As noted in the evidence laid out here earlier, they do very little to stimulate real economic growth. But a scam artist like Stephen Moore, a fixture on CNBC, CNN, MSNBC and, of course, Fox News, can find new and clever ways for concealing the truth.