Insider's Game

Selected writings by David Fiderer

The Real Reason Fannie and Freddie Lost So Much Money

First published in The Huffington Post on January 5, 2011

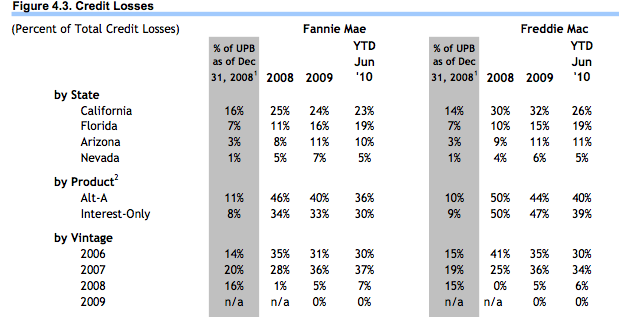

How did Fannie and Freddie lose so much money? There are many reasons, but the two most important ones are Alt-A and interest-only loans, which generated most of the losses. These are not products for low or moderate-income borrowers. But they are products that invite fraud. Reports by the Federal Housing Finance Agency and the St. Louis Fed lay it all out in context. Once again, we see how the root causes of the real estate bubble are traceable to interest rates and fraud.

Interest Rates: Greenspan’s Boom/Bust Cycles

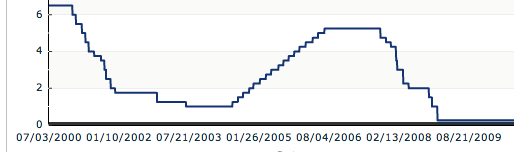

The chart below from the St. Louis Fed is one of the best illustrations anywhere of how Fed policy creates predictable boom/bust cycles in the mortgage lending business. It could be titled, “What Alan Greenspan Wrought.”

Since the 1980s, lenders have benefited from booms caused — not by loans for new home purchases, which rose steadily year after year — but by refinancing waves caused by drops in mortgage rates. Each ensuing bust, or sharp drop in refinancing volumes, began after rates started rising, or after everyone who wanted to refinance had already done so.

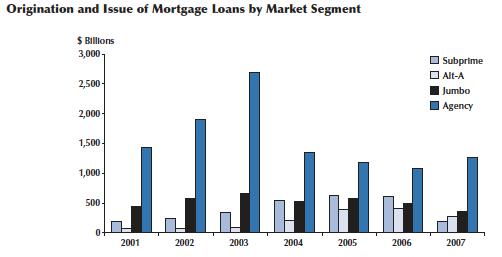

The chart illustrates two successive boom/bust cycles. The first applied to Fannie and Freddie (the Agencies), which specialized in 30-year fixed-rate loans. There was a 2001 – 2003 boom, when 90% of the GSEs’ loans were fixed-rate. “Between 1971 and 2002, the fed-funds rate and the [fixed] mortgage rate moved in lockstep,” wrote Greenspan. On December 31, 2000, the fed-funds rate was 6.5%. Six months later it was 3.75%. By year-end, it was 1.75%. He triggered the biggest refinancing boom in history, which accelerated when he slashed the Fed Funds rate to 1.25% in November 2002. At the end of 2000, America had $5.1 trillion in single-family residential mortgage debt. During 2001- 2003, $6.1 trillion had been refinanced (page 21 of Greenspan’s study) .

Fed Funds Rate

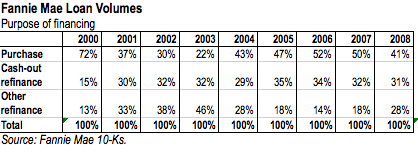

During the ensuing bust of 2004 – 2006, the GSEs’ loan volumes fell by more than 60%. The dropoff could have been worse but for the spike in cash-out refinancings, which were rationalized by rising real estate values. Fiscal year 2000 was the last time that a decisive majority of Fannie’s loans were extended for home purchases. It was more a matter of people using their homes as piggybanks, as opposed to people buying homes they couldn’t afford. It was a phenomenon that Greenspan followed closely.

Subprime/Alt-A and ARMs

The second cycle, which applied to subprime and the Alt-A loans, began with a 2004 – 2006 boom. The subprime/Alt-A bust began in 2007 and continues into the indefinite future. This was the first-ever boom tied to short-term interest rates. The St. Louis Fed, tracking the data on mortgage securitizations, shows how in 2004, for the first time ever, the majority of Alt-A originations were ARMs. Over three-quarters of subprime loans were ARMs, with the lion’s share subject to reset after three years.

Greenspan promoted the second refinancing boom, both by continuing to reduce short-term rates after fixed-rate mortgage pricing flattened out in 2002, and by promoting ARMs. “Alan Greenspan said Monday that Americans’ preference for long-term, fixed-rate mortgages means many are paying more than necessary for their homes and suggested consumers would benefit if lenders offered more alternatives,” wrote USA Today on February 24, 2004.

But ARMs blow up.

ARMs are much riskier than fixed-rate loans. Their failure rate shoots up whenever interest rates rise. Lew Ranieri, who invented mortgage securitizations and warned regulators and the rating agencies about reckless lending practices five years ago, explained the problem with ARMs last August, at lunch meeting hosted by Treasury and HUD to discuss, “Funding Housing and the Role of Securitization.” he said:

I can give you a history of how many different types of floating rate loans we tried simply because the market wants more floating rate than it wants fixed. Every one of them blew up until Jim Montgomery created the California ARMs with caps and a floor. We never had a floating rate that didn’t blow up on us. And that one is only a collar. All of these other structures that we have now never stood the test of time. You have nothing to prove to me that it’s not going to blow up in your face.

So the only structure that we know that has stood the test of time, when they don’t monkey with it, is the 15-year self-amortizing and the 30-year and the Jim Montgomery [coffee?] ARM, although that’s only a collar. So when there are violent interest rate moves it gets kind of scary.

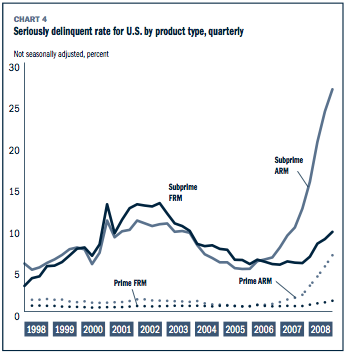

So as surely as the sun sets in the west, ARMs started defaulting after the fed-funds rate moved upward and their initial teaser rates were reset. In May 2004, the fed-funds rate was 1%. In May 2006, the fed-funds rate was 5%. Viola. Delinquencies among all ARMs spiked. By June 30, 2008, the rate of serious delinquencies among subprime ARMs was five times what it was three years earlier, according to the Mortgage Bankers Association. Serious delinquencies among prime ARMs had increased more than tenfold over the same period.

Source: Mortgage Bankers Association

Fraud: Government Policy to Keep the GSEs Out of Subprime

“Evidence indicates that the vast majority of mortgage fraud and predatory lending activities — including excessive fees, provision of credit life insurance and prepayment penalties — occurs in the conventional subprime lending market,” said HUD Secretary Andrew Cuomo in 2000, citing a joint HUD/Treasury study on the topic. So the Clinton Administration drafted regulations to shut Fannie and Freddie out of the segment of the subprime market dominated by Wall Street securitizations. Cuomo wanted to go further, and lobbied for legislation to categorically prohibit many subprime lending practices. But at the end of the day, his influence only extended to the GSEs. Phil Gramm prevented any legislation from moving forward, and Alan Greenspan, who had the authority to oversee and regulate the mortgage lending business, continued his steadfast policy of refusing to do anything.

Out of concern that, “mortgages with predatory features undermine homeownership by low-and moderate-income families in derogation of the GSEs’ Charter missions,” (65 FR 65069, Oct. 31, 2000), Cuomo’s HUD excluded ”Mortgages contrary to good lending practices,” from being counted toward meeting Affordable Housing Goals (65 FR 65085). HUD also said it would also exclude “B&C loans” (i.e. subprime loans) from its calculation of the size of the overall market. (65 FR 65090).

The new regulations specifically excluded loans with: (a) Excessive fees, (b) Prepayment penalties, (c) Single premium credit life insurance, (or d) Evidence that the lender did not adequately consider the borrower’s ability to make payments, plus any loans that the HUD secretary deemed to violate good lending practices. The GSEs could not include any loans from any lenders that steered prime borrowers to higher priced subprime products, or, acting as a loan servicer, failed to accurately report a borrower’s repayment history.

Cuomo’s exclusion of prepayment penalties, with limited carve-outs, made it almost impossible to buy into a mortgage securitization — subprime or otherwise — comprised of ARMs. Investors and rating agencies demand those penalties as an offset the prepayment risk in a static loan pool. Otherwise, creditworthy borrowers would refinance whenever rates moved in their favor, while the weaker borrowers, who could not refinance, worsened the default rate.

Private Label Deals Are The Worst

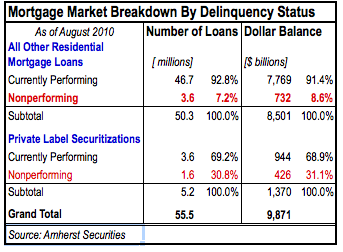

Cuomo’s regulations stood the test of time because mortgages financed by Wall Street’s private label securitizations performed exponentially worse that the rest of the market. A report from Amherst Securities divides mortgages between private label securitizations and everything else, including GSE loans. For private label deals, the rate of nonperformance is 31.1%; for all other mortgages, it’s 8.6%. An FHFA comparison between GSE and private label loan performance confirms that:

The relatively worse performance of private-label MBS-financed mortgages was consistent across origination years and, within each year, across nearly all groups of loans with similar LTV ratios and FICO scores.

Violating the Spirit of Anti-Predatory Regs

Whether or not the GSEs followed the spirit and letter of those regulations is an entirely different matter. Then there’s the question of whether the Bush Administration exerted any effort to enforce the regulations against predatory lending or the laws against mortgage fraud.

Interest-only loans or option ARMs, which make principal paydown optional, seem no less predatory than the products that Cuomo specifically excluded. These products have no legitimate business purpose. Consider a $100,000 amortizing mortgage with 6% interest. The monthly installments are $600. The installments on an interest-only loan are $500. If you can’t handle that $100 difference, then you can’t handle an upward shift in short-term interest rates, or a decline in the value of your home.

Alt-A should not be conflated with subprime. Look for a definition of Alt-A or subprime and you’ll most likely get a fuzzy answer. Both segments show off high levels of fraud and high delinquency and default rates. But they are intended for very different market segments. In general, Alt-A borrowers have high FICO scores — they are normally categorized as “A” rated — and they finance less than 80% of the appraised value. At year-end 2008, the average FICO scores of Fannie’s and Freddie’s Alt-A loans, 719 and 725 respectively, were almost identical to that of their overall portfolio balances, and they financed, on average, 72% of the appraised property value. The key distinguishing characteristic about alt-A loan packages is that they have low documentation. The source of the of the borrower’s income is frequently not confirmed. In addition, if the Alt-A loan were originated from a non-bank lender, the transaction would have escaped the scrutiny of anti-money laundering rules, which required documentation of the source of the initial down payment. In other words, the deal bypassed two key protections against fraud. The sources of credit comfort aren’t necessarily worth much, since FICO scores can be rigged, and home appraisals can be inflated.

FICO scores are not based on income, which is why subprime borrowers should not be equated with low-income borrowers. Subprime is almost always defined as a borrower below a certain FICO cutoff. Moody’scategorized mortgages according to FICO score: Subprime was below 625, Midprime was 625 – 700, Prime was above 700. The weighted average FICO of the ABX subprime indices was around 630.

Fannie and Freddie’s originations, as segmented by FICO scores, were remarkably stable. And the overwhelming majority of loans in all categories were fixed-rate. The problem was that, within the subset of ARMs and among the high-FICO borrowers, they offered the worst types of loan products. Those loans definitely did not fit the requirements for the GSEs’ Affordable Housing Goals.

How the Worst Loans Overlapped

The FHFA laid out what went wrong. First, it confirmed the two immutable rules of real estate lending: 1. Location, location, location; and 2. Timing is everything. That is, the biggest losses were in the states which saw the biggest price declines, and the biggest losses were from loans booked close to the peak of the bubble, which was around June 2006. All these categories overlap. A disproportionate share of Alt-A loans were booked near the peak of the bubble in states which saw the biggest price declines, and a disproportionate share of those loans were ARMs or interest-only.

The Private Sector Enabled Fannie and Freddie To Lay Off The Risk

Look back to the first chart from the St. Louis Fed, and you can figure out what happened. The GSEs were like most private lenders. When faced with reduced revenues and profits from their core business, they became willing to make up the shortfall by going downmarket. How did they get comfortable with the increased risk? With private mortgage insurance. The private market, in its wisdom, chose to insure almost all of the Fannie’s and Freddie’s loans with an original LTV in excess of 90%. Private insurers covered more than 30% of the GSEs’ exposure to all loans with FICO scores below 660. They covered 35% ofFannie’s interest-only exposure and almost 40% of its Alt-A exposure. Of course, GSEs made the mistake of believing that those insurers’ double-A and single-A ratings meant something.

Even worse, they made the mistake of believing in the triple-A ratings assigned to the private label Alt-A and Option-ARM bonds they acquired. Those bonds incurred $25 billion in writedowns.

Bottom Line: At the end of the day, the GSEs’ biggest problems came from loans that had nothing to do with Affordable Housing Goals, because the worst loans had the predatory attributes that some politicians had sought to outlaw. The GSEs’ chief enabler for acquiring toxic loans was the private insurance market, and, perhaps, regulators who were indifferent to the dangers of predatory lending.