Insider's Game

Selected writings by David Fiderer

Gov’t. “Watchdog” Bamboozles Press About Fannie and Freddie

First published in on August 22, 2013

If Steve Linick, Inspector General of the Federal Housing Finance Agency, set out to bamboozle the press and the public, he succeeded beautifully.

With the notable exception of Nick Timiraos at The Wall Street Journal, just about every other major news outlet was tricked into believing that Fannie Mae and Freddie Mac were less than scrupulous about posting credit losses on their books. Check out these headlines:

Fannie, Freddie masking losses, FHFA watchdog report says, Reuters

Fannie Mae, Freddie Mac delaying write-offs of delinquent mortgages, Los Angeles Times

“A government report raises questions on how Fannie and Freddie account for future losses. Mandated changes, once in effect, could eat into their profits as the housing market recovers.”

Fannie Mae, Freddie Mac disregarding potential losses, Bloomberg

None of those claims is true. The issue under discussion would have a de minimis impact on the GSEs’ reported earnings, probably something close to zero. But, given the false and misleading insinuations set forth in the IG’s report, it’s easy to see how reporters, always burdened by tight deadlines, were tricked.

If I weren’t familiar with banking and accounting terminology, and with Fannie and Freddie’s financials, I might have fallen for the IG’s obfuscatory rhetoric as well. Here’s a key passage of the IG report, which, for the most part, is BS. An explanation and translation into plain English follows:

FHFA examination staff identified no later than January 2012 a significant risk management issues relating to loan loss reserves, with potentially significant consequences for Fannie Mae and Freddie Mac, concerning the treatment of loans delinquent for more than 180 days.

Appropriately classifying assets according to risk characteristics is a key safety and soundness practice that could have an impact on loan loss reserves. The loan loss reserve is a critical/significant accounting estimate for both Fannie Mae and Freddie Mac.

FHFA recognized the issue’s significance when it issued the advisory bulletin in April 2012, directing the enterprises to classify loans delinquent for more than 180 days as a “Loss.” The bulletin notes that it is consistent with the system for loan classification followed by federal banking regulators.

The bulletin states that it “embodies a basic principle in GAAP that losses should be recognized on loans that are deemed uncollectible and that there should be no delay in loss recognition of probable incurred losses.” (Emphasis added). Yet, it will not be fully implemented until January 2015, three years after the issue was first raised.

How Credit Losses Are Booked

First of all, here’s how Fannie and Freddie recognize credit losses, in really simple terms. They look at their delinquent loans and then estimate a default rate (based on recent default rates) and a loss per property (based on the expected sale proceeds and mortgage insurance proceeds versus the loan balance). That estimated credit loss is expensed on the income statement for the current period. On the balance sheet, the loan amounts are not reduced, but the new loan loss reserve reduces total assets by the amount of the loss expense on the income statement.

Later, when foreclosure proceedings are actually initiated, a GSE will write down the face amount of the loan by the amount of the loss reserve, which is then extinguished. All of this is fully compliant with GAAP, and, if you parse the IG report carefully, no one is saying–as opposed to suggesting and insinuating–that the GSEs’ financial accounting is not entirely proper.

A Simple Example: Here’s a very simple example, which assumes that a GSE has only one loan on the books:

In the 1st quarter, a GSE estimates a 20% loss on a $100 loan. So current income is reduced by $20, and a $20 loan loss reserve is netted against the loan on the balance sheet, so that total loan assets, which were previously $100, now equal $80.

Then, in the 4th quarter, foreclosure proceedings are initiated, at which point the loan, which was previously $100, is now valued at $80, but the offsetting entry is the elimination of the $20 reserve. Total loans on the balance sheet, which were $80 before, are still $80.

Again, the initial loss provision in the 1st quarter affects income and net worth; the loan write-off in the 4th quarter is a wash, because assets are simply shifted from one account to another.

So WTF is the Inspector General talking about? Nothing subtstantive.

All along, the GSEs maintained their own systems of risk classification for loans in various stages of delinquency. And, consistent with accounting standards, they booked credit losses as soon as they saw signs of trouble. Over the past seven years, the GSEs methods for booking credit losses have proved to be excessively conservative, because actual proceeds from foreclosure liquidations were higher than the GSEs estimates of recovery.

In April 2012, the FHFA announced that the GSEs should change over to the risk classification systems used by bank regulators. Every banker knows those risk categories, which also represent successive stages of deterioration: Pass, Special Mention, Substandard, Doubtful, and Loss.

Generally speaking, a bank assigns a loss provision to any loan that has deteriorated to the Substandard category. The loss provision may increase as the loan deteriorates to Doubtful. When a loan is classified as Loss, the loan is written down, so, as in the GSE example above, the $100 loan and the $20 loss reserve will be converted into an $80 loan with no reserve. But the actual losses hit the income statement much earlier.

In terms of substance, what is the difference between the GSEs and the banks? The GSEs write down their loans as soon as the loan servicer initiates foreclosure proceedings, whereas, under bank regulations, the loan must be written down once it becomes 180 days delinquent. But again, writing down the loan should not impact the income statement. It’s a timing difference that should wash out over time.

Yet the IG insinuates things that are not true:

It insinuates that the GSEs were not maintaing proper risk classifications for their loans.

- It insinuates that the date when a loan is written down is the same as the date when the credit loss is recognized on the income statement.

- It insinuates that the GSEs failure to follow bank regulators’ terminology, which designates retail mortgage loans in the “Loss” category once a loan is 180 days delinquent, is the same thing as failing the recognize a loan loss provision on the income statement.

- It insinuates that the GSEs are not fully compliant with Generally Accepted Accounting Principles, which debunked by the unqualified opinions from Fannie and Freddie’s auditors, Deloitte & Touche and PricewaterhouseCoopers.

And the usual suspects embellish false insinuations to amplify the media narrative

As you would expect, the usual GSE haters took the media narrative and ran with it. As with Steve Linick’s dubious report, all of the big accusations against Fannie and Freddie follow one singular template; they rely on word games to fabricate some kind of false equivalency, and they ignore empirical data that nullifies the accusation.

Take, for instance, Ed Pinto’s claim that the GSEs caused the mortgage crisis because of all their subprime lending. He contrived a false equivalency between Pinto-designated “subprime” mortgages and “subprime” mortgages as designated by everyone else, and, since 2008, he refuses to ever discuss empirical loan performance in the context of the GSEs versus the rest of the market.

Pinto disciple Chris Whalen follows that template with, “Are Fannie Mae and Freddie Mac Really Profitable? Really?”

Whalen is a bank analyst, so, unlike the man on the street, he should know the difference between a loss provision and a write-down, and the difference between recognizing a loss for accounting purposes and a regulatory classification of “Loss.” And he knows how to read Fannie and Freddie’s public filings, which disclose the information that he chooses to bypass.

Let’s start with what he overlooks. From here on in, we will get into the weeds of accounting and financial analysis:

First we start with Page 96 in the notes to the consolidated financial statements. As of June 30, 2013, FNM had about $140 billion in total delinquent loans on its balance sheet, including about $80 billion in the “seriously delinquent” category. Good guess for loss given default on this subset of bad paper is well north of the high 20% rates that FNM is reporting on current disposals and the 40% loss severity rates we hear discussed in polite society. One particular RMBS veteran thinks the severity on the 04-08 vintage is more like 60-70% because so much of the underlying collateral remains under water. The remaining delinquent loans total about $60 billion. FNM has about $50 billion in reserves set aside to cover losses on these bad loans and other assets.

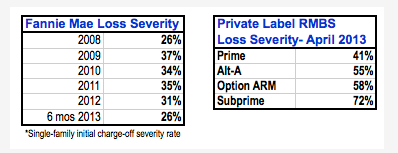

OK then, as of June 30, Fannie had a $2.8 trillion single-family mortgage book, $140 billion in delinquent loans, and a $50 billion loss reserve, which assumes a loss severity of about 35%, which, Whalen insinuates, is far too low.

As you would expect, the usual GSE haters took the media narrative and ran with it. As with Steve Linick’s dubious report, all of the big accusations against Fannie and Freddie follow one singular template; they rely on word games to fabricate some kind of false equivalency, and they ignore empirical data that nullifies the accusation.

Take, for instance, Ed Pinto’s claim that the GSEs caused the mortgage crisis because of all their subprime lending. He contrived a false equivalency between Pinto-designated “subprime” mortgages and “subprime” mortgages as designated by everyone else, and, since 2008, he refuses to ever discuss empirical loan performance in the context of the GSEs versus the rest of the market.

Whalen frames his analysis on the premise that Fannie is lying, because it has always lied:

After years, no, really decades of obfuscation and outright mendacity, are the folks at Fannie Mae and Freddie Mac really telling us the truth now about their financial condition? Washington is a city of lies, let us remember, with a good part of the population paid to disseminate falsities as part of their job description. But the biggest lie of all was allowing the GSEs to avoid marking their impaired assets down to fair value as commercial banks are required to do. Had this been done, the losses reported by the enterprises would have been far larger.

Speaking of which, we are still waiting to see how Whalen’s other prediction, about Fannie and Freddie concealing $100 billion in losses, plays out.

As for the years of obfuscation and mendacity, check out:

Fannie Mae “Accounting Scandal” Discredited In Court

SEC Reversed Its Initial Charges Re: Fannie Mae’s “Accounting Fraud”