Insider's Game

Selected writings by David Fiderer

Sham Transactions That Led to AIG’s Downfall: The Ugly Truth Was Hiding In Plain Sight

First published in The Huffington Post on January 29, 2010

If you want to understand the deals that wiped out AIG, the best place to start is the website of the New York Fed. In the financial statement of Maiden Lane III, published last April, we see the gory details of the three largest CDO investments – Max 2008-1, Max 2007-1, and TRIAXX 2006-2A – acquired from AIG’s banks at par. Those deals, which totaled $10.7 billion, offer a template for evaluating the other sham transactions in the portfolio.

Initially, the business deal between AIG and the banks was that AIG sold credit default swap protection. Banks buy credit default swaps for two reasons: They want to slice and dice their credit risk, and/or they want to hide something. Here’s a simple, fairly innocuous, illustration: Suppose you’re a banker who tells his client, Procter & Gamble, “We want to expand the relationship and do more business with you.” P&G then says, “Fine, lend us $100 million.” Back at the office, your senior credit management says, “The maximum risk exposure we approve for P&G is $80 million.” How do you keep in P&G’s good graces? You lend the company $100 million, and simultaneously offload $20 million in risk exposure by purchasing a credit default swap from another bank. P&G’s understanding is that you’ve lent them $100 million.

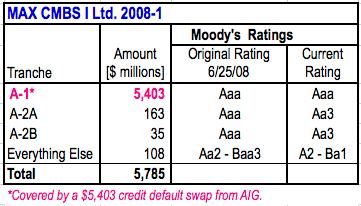

When Deutsche Bank bought a credit default swap from AIG in 2008, its primary motivation was not to slice up the credit risk, but to hide virtually all of it. Max 2008-1, a CDO that Deutsche arranged and closed on June 25, 2008, was huge. The total debt issue was $5.8 billion, of which 94%, or the entire $5.4 billion Class A-1 tranche, was covered by one credit default swap issued by AIG Financial Products. The Class A-1 tranche was considered “supersenior” because it was ahead of two other tranches, both originally rated Aaa, which totaled $200 million. (The remaining $200 million worth of debt was rated Aa, A and Baa at closing.)

Put another way, Deutsche Bank did not bring Max 2008-1 to “the marketplace,” where investors might consider buying the deal on its own merits. By normal standards, the “market” for this CDO never really existed. Nor did Deutsche sell the deal to AIG, which could have assumed both the risks and rewards of owning a huge CDO. (In all fairness, we do not know where the remaining 6%, or $400 million, of less-senior tranches ended up. Deutsche could have kept them in inventory to be stuffed into a yet another CDO.)

Almost all circumstances surrounding Max 2008-1 seem weird. We do not know much about the $5.4 billion Class A-1 tranche, except that it was never downgraded below its initial Aaa rating. Yet, according to Deutsche Bank, AIG and Maiden Lane III’s accountants, the underlying value of Max 2008-1 collapsed within a matter of months. By the time that the government agreed to acquire the CDO at par, the Class A-1 tranche purportedly had a negative “mark-to-market” of $2.5 billion. (As noted earlier, accountants, both for AIG and the Fed, determined that that there was no market benchmark for valuing any of the CDOs.) So did AIG turn over $2.5 billion in cash collateral to Deutsche? No. It turned over $4 billion, as revealed inAIG’s filing with the SEC, dated May 15, 2009.

Among the hundred plus CDO deals to which AIG extended credit protection, the only ones which received collateral postings in excess of the “negative market-to-market” were the two biggest: Max 2008-1 and Max 2007-1, as revealed in the SEC filing of May 15, 2009. Together, those two CDO tranches had a par value of $7.5 billion and a “negative market-to-market” of $3.5 billion at the time Maiden Lane III closed. But AIG had already turned over $5.6 billion in collateral to Deutsche Bank, $2 billion more than what anyone thought to be necessary.

Everything about Max 2008-1 suggests that the parties were not acting on an arms-length basis, that they had something to hide. A deal rated Aaa doesn’t decline in value by 40% within months after closing and still retain its Aaa rating. (The more junior tranches received moderate downgrades on March 19, 2009.) A cash-strapped insurance conglomerate does not turn over $2 billion in excess cash collateral for no reason. AIGFP had unsuccessfully struggled for the better part of a year to establish an agreed-upon method for calculating the amounts of cash collateral postings on these credit default swaps. It seems more than a little odd that it would choose to expand this problem with a credit derivative more than twice the size of its next largest CDO exposure. And it seems especially odd that it would close such a deal in June 2008, one month after Moody’s and S&P had downgraded AIG, and issued warnings that further downgrades could be coming.

What becomes obvious, after reviewing Max 2008-1, Max 2007-1, and TRIAXX 2006-2A, is that these deals never could have been done but for AIG’s willingness to assume the lion’s share of the credit risk.

TRIAXX 2006-2A was a $5 billion deal, of which AIGFP assumed $3.2 billion, or 64%, of the credit risk. AIGFP provided credit protection in three different tranches, all of which were rated AAA at closing. The sole underwriter and arranger for the $5 billion CDO, which closed in December 2006, was an outfit calledICP Securities LLC, a private firm owned by its employees. In retrospect, it seems remarkable that AIG would have assumed such a large exposure in a deal structured by a relatively small private company. Nonetheless, ICP was able to sell its deal into the marketplace, if that’s the correct way to characterize it. Of the $3.2 billion in credit protection sold by AIG, $2.5 billion was purchased by Goldman Sachs, another $0.4 billion was acquired by an affiliate of Dresdner Bank, and $.03 billion was acquired by a company of unknown origin, called CORAL Purchasing (Ireland) Limited. All of this information was disclosed by AIG to the SEC on May 15, 2009.

The Aaa ratings at TRIAXX 2006-2A remained in effect at the time AIG collapsed, and at the time the CDOs were sold at par to Maiden Lane III. Nonetheless, Goldman had demanded, and received about $1 billion in cash collateral postings prior to the date when the New York Fed took the exposure off of AIG’s books. About a month after Maiden Lane III closed out its books for the year, on December 31, 2008, TRIAXX 2006-2A suffered a downgrade, to Caa.

Those eight-month-old public disclosures are very incomplete, but they reveal a lot. They indicate that these CDO deals were not, by any stretch of the imagination, conducted on an arms-length basis, and that these transactions took forms that were designed to conceal the true economic interests of the parties. I’m always amazed by what people, especially people not from the financial world, don’t know. Big banks are not like the Pentagon or the Coalition Provisional Authority. Billion dollar amounts do not just slip through the cracks. There is no way that the very top people at AIG and Deutsche Bank would not be thoroughly briefed about every aspect of a $5.4 billion credit default swap for a CDO called Max 2008-1.

The newly disclosed information, which reveals the redacted parts of AIG’s May 15, 2009 filing, serves to confirm what we already realized. At AIGFP’s CDO business, nothing was what it seemed.