Insider's Game

Selected writings by David Fiderer

The Simple Arithmetic of David Brooks’ Deceitful Claims on Health Care Reform

First published in The Huffington Post on July 20, 2009

If you make $1 million a year, the impact of the proposed health care surcharge is a blip, a rounding error. If you make less, the impact is disproportionately smaller. Only a tiny percentage of millionaires — not those people whose net worth exceeds $1 million, only people whose annual earnings far exceed $1 million — would ever pay a significant dollar amount for the tax surcharge associated with health care reform.

To obscure this obvious truth, David Brooks launched a series of deceptions on the Chris Matthews Show. First he tried to inflate the proposed marginal tax rate:

They got a House bill out, they’ve got a Senate bill moving forward. They’re scaring the dickens out of the moderates in their own party, let alone the Republicans. They’re scaring the dickens out of them because the House bill calls for raising the top tax rate to 52 or in some cities 57 percent. That’s higher than in France, Spain, Italy…

Of course, the House bill does no such thing. Brooks lumped in the potential impact of state and local income taxes from places like New York City, but he made it sound as if the burden came only from the federal government. Matthews quickly corrected him. “You mean when you add up the state and local,” he said. But Brooks made sure to interject all the standard Republican talking points:

When you add the — this new tax surcharge they’re going to put on everybody — on the rich people’s taxes. That is just placed terribly for small business people in the Midwest. And in both bills, House and Senate, there’s no serious cost control. So they’re making some progress, but they are — they’re proposing a bill, I think, that is way out of touch with where the American people are and their anxieties.

Here’s how “this new tax surcharge they’re going to put on everybody, ” which is “placed terribly for small business people in the Midwest” and “way out of touch with where the American people are and their anxieties,” actually works:

If you make $350,000 a year or less, you incur zero additional income taxes. If you make $500,000 a year, your tax bill goes up by $1,500, or about $4.11 a day. If you make $1 million a year, your tax bill increases by $9,000. If you think $9,000 is a big deal to someone who earns $1 million a year, you don’t know anyone who makes that kind of money. Those are the people whose multimillion-dollar investment portfolios rise and fall by more than $10,000 on any given day. (One percent of $1 million is $10,000.) Those are the people who assured me how easy it was for Sarah Palin to spend $150,000 on a few outfits at Saks and Nordstrom’s.

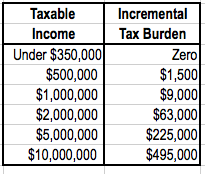

If you earn a lot more than $1 million a year, the dollar amounts begin to look meaningful. Here’s the incremental impact along the taxable income food chain:

But again, this is the impact on individual tax returns. It’s a standard Republican conceit to equate individual income taxes with the burden on small business, as if a million-dollar increase in Bill O’Reilly’s taxes, or in the tax bill of a Goldman Sachs executive, will stifle small businesses in the Midwest. Brooks was amplifying the deceptions put forth in right-wing outlets like the Washington Times, which tried to deceive its readers into believing that the 5.4% rate of the surcharge, which only kicks in on your second million of annual income, applied across the board:

Small-business owners are warning that the economy would suffer under a health care bill proposed by House Democrats, which would drive tax rates for high-income taxpayers to levels not seen since before President Reagan’s tax reform of 1986…”If they institute a 5 percent surtax on income, it will have a severe impact on small businesses that are already hurting,” said Michael Fredrich, whose Wisconsin company, MCM Composites, molds plastic parts. “We run maybe three days a week, sometimes four days a week, sometimes zero days,” he said. “I can tell you that at some point, people … running a small business are just going to say, ‘To hell with it.’ ”

Matthews played along, asking one of those rhetorical questions with a bogus premise:

So back to the question I raised with you 10 minutes ago: Would you rather be a member of Congress from a suburban district who voted for a big health care bill with a nice signing ceremony, but at the end of the game you’re asked back home, “Why’d you raise my taxes to 57 percent?”

How many voters do you know who live in the suburbs and make well in excess of a million a year? Matthews, who makes more than $4 million a year, is out of touch with the real America.

Brooks continued his selective and misleading claims right until the end of the program, when he asserted:

Moderate Democrats, mild-mannered Democrats getting up at Democratic meetings in Capitol Hill and complaining about some of the specific provisions in the health care bill. For example, the taxes in the House bill would go up in 2011. It wouldn’t actually take effect till 2013. 2012 you’d have taxes but no benefits. 2012 happens to be an election year. They hate that. That’s the sort of thing they’re hating in this bill.

As Change.org explained, the delay in implementation is most likely driven by a shortage of qualified medical care providers. Brooks’ “taxes but no benefits” equation is deceitful because people who make in excess of $1 million a year don’t worry about their medical costs.

No one on Matthews’ program mentioned that House Bill 3200 was endorsed by the American Medical Association.

Note: The tax impact referenced above refers to families instead of individual filers, but the order of magnitude of the financial impact on singles is not materially different.