Insider's Game

Selected writings by David Fiderer

IMF Numbers Show a Great Economic Hole That Will Frame Partisan Debate

First published in The Huffington Post on April 22, 2009

The headline,“2008 profits plunge 85% for top 500 US firms,” is largely about three wards of the state. AIG, Fannie Mae and Freddie Mac, together lost $208 billion. Add in the losses at Citigroup and Merrill Lynch, which totaled $56 billion, and the cumulative 2008 profits at the 495 remaining companies in the Fortune 500, were largely eclipsed. The total net among all 500 was $99 billion.

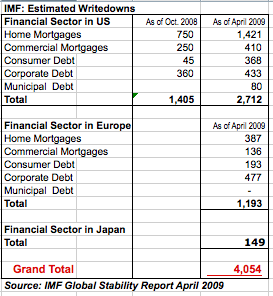

Those 2008 losses dwarf the positive results reported by banks this past week, which, as HuffPo’s Julie Satow points out, were largely driven by accounting adjustments and one-time transactions. Those first-quarter profits may turn out to be a rounding error, if the estimates set forth in the International Monetary Fund’s Global Stability Report prove to be correct. Nobody has a good take on the ultimate costs of the mortgage crisis, but the IMF believes the size of the problem is about double the amount estimated six months earlier. U.S. banks, which had $510 billion in write-downs through year-end 2008, can expect to write down another $550 billion in 2009 and 2010.

As for the entire U.S. financial sector, the IMF calculated credit losses six months ago to be in the neighborhood of about $1.4 trillion. Now the number is $2.7 trillion. As we see, most of the downward slide in the U.S. was attributable to home mortgages and consumer debt.

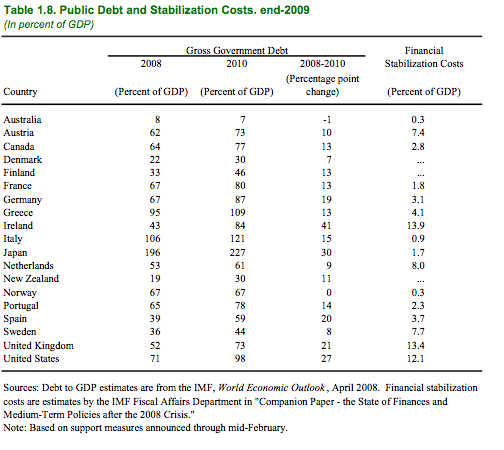

We are stuck with those losses whether we follow the policy direction set forth by Timothy Geithner, or Paul Krugman, or Elizabeth Warren. No serious person, and no one at the IMF, doubts that governments need to aggressively intervene to prop up the financial system, and that the cost of such intervention will be a drag on government finances for years to come. The IMF estimates that by the end of 2010 we will have spent 12.1% of our GDP on stabilizing the banks and the financial sector. Ireland’s debt, as a percentage of GDP, will almost double. It is what Barney Frank called, “The great economic hole.”

These numbers tell us all we need to know for the next two election cycles. Republicans and their allies will play off of resentment of the bailout, arguing that the financial costs are the result of the liberals’ tax-and-spend policies, and that Obama’s deficits dwarf those from the early Bush years. That effort is well under way at the tea party network, Fox News. Some notables at CNBC are also prone to echoing that sentiment.

The President and other Democrats will note that they are forced to clean up the mess created by their Republican predecessors. But memories can be short and patience will wear thin.

And Republicans are intent on revising the past with three recurring narratives:

1. Blaming the cause of the mortgage crisis on Fannie Mae and Freddie Mac,

2. Blaming the Democrats for insulating Fannie Mae and Freddie Mac from regulatory oversight, and

3. Claiming that subprime lending ran amok because of the Community Reinvestment Act.

Barney Frank gave a speech on the House floor to set the record straight. “I do not argue that we are facing a vast right-wing conspiracy,” he said. “What we are dealing with is something, however, equally troubling. It is crass right-wing mendacity. It is systematic dishonesty, lying, distortions, misrepresentations, bad history being promulgated.”

Rep. Frank was talking about hit pieces like this one, fabricated by Bret Baier for Special Report on Fox News. The segment has gone viral, with 4.3 million hits on Youtube.

For a definitive refutation, read Barney’s Frank’s speech.